How Pvm Accounting can Save You Time, Stress, and Money.

Table of Contents5 Easy Facts About Pvm Accounting ShownSome Known Facts About Pvm Accounting.7 Easy Facts About Pvm Accounting ShownThe 30-Second Trick For Pvm AccountingPvm Accounting - The FactsPvm Accounting Things To Know Before You Buy

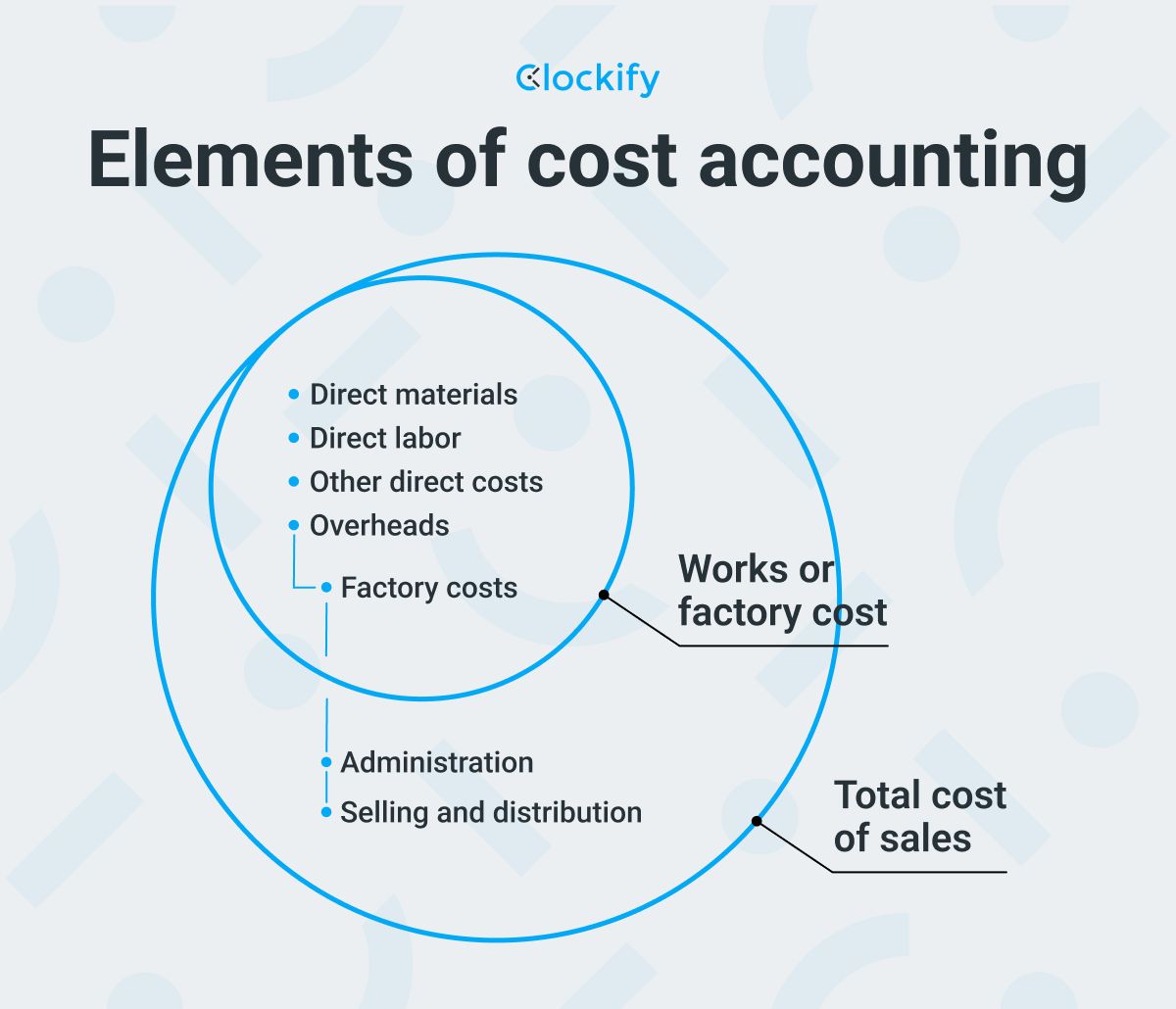

Coverage straight to the CFO, this individual will have complete ownership of the accountancy function for 3 entities, while managing a group of 3+ individuals. It features teacher Joann Hillenbrand, CCIFP who currently serves as the Principal Financial Policeman for Airco Mechanical, Incorporated. Joann has more than 30 years of experience in construction audit and instructs pupils a variety of skills, including: agreement management bookkeeping cash money management monetary statement administration building bookkeeping basics construction danger monitoring principles (consisting of insurance coverage) The program costs $865 to get involved in.Instead, firms often require degrees and experience (i.e. full time employment or internships). Construction accounting professionals look after financials on projects and for their firms overall. Obligations include: planning/coordinating project financials looking after different kinds of monetary evaluation (i.e. project cost quotes) examining economic files (i.e. billings, contracts, etc) tracking costs and revenue evaluating (and determining ways to address) economic risks, both on specific jobs and those affecting the business overall preparing and sending economic reports, both to stakeholders and pertinent governing bodies To come to be a building accounting professional, an individual must usually have a bachelor's degree in an accounting-related area.

About Pvm Accounting

Discover more regarding Bridgit Bench, a workforce planning application built to aid building and construction experts (including building accountants) manage various aspects of their job more successfully. Michel Richer is the Supervisor of Material and Item Advertising at Bridgit. He began in the building industry at an early stage with a local restoration firm.

A building and construction accounting professional prepares economic statements, monitors expenses and budget plans, and deals with project supervisors and partners to make sure that the firms financial demands are satisfied. A building and construction accountant functions as component of the accountancy division, which is accountable for creating economic reports and why not check here analyses. Building accounting professionals may likewise help with payroll, which is a kind of audit.

The Only Guide for Pvm Accounting

Proactively resolving cost and functional related issues with project managers, property supervisors, and other inner job stakeholders daily. Partnering with inner task administration teams to guarantee the economic success of the business's growth jobs utilizing the Yardi Task Price component, consisting of establishing projects (tasks), budget plans, contracts, adjustment orders, order, and handling invoices.

Digital Real estate brings companies and information with each other by supplying the complete spectrum of data center, colocation and affiliation solutions. PlatformDIGITAL, the firm's worldwide data center system, gives customers with a secure data meeting area and a proven Pervasive Datacenter Architecture (PDx) service methodology for powering innovation and successfully taking care of Data Gravity challenges.

The Definitive Guide to Pvm Accounting

In the very early stages of a construction organization, business proprietor likely handles the building accountancy. They handle their own books, deal with balance dues (A/R) and payable (A/P), and oversee pay-roll. As a construction service and checklist of tasks expands, nevertheless, making monetary decisions will certainly reach beyond the role of a single person.

For several months, or even a number of years, Bob performs all of the necessary audit tasks, several from the taxicab of his vehicle. https://pvm-accounting.webflow.io. He handles the money flow, gets new credit lines, chases down unpaid billings, and puts all of it into a solitary Excel spread sheet - construction taxes. As time goes on, they realize that they barely have time to take on brand-new projects

Quickly, Sally ends up being the permanent accountant. When receivables hits six numbers, Sally realizes she can not maintain. Stephanie signs up with the audit team as the controller, ensuring they're able to keep up with the building and construction tasks in 6 various states Determining when your building and construction business awaits each duty isn't cut-and-dry.

Getting My Pvm Accounting To Work

You'll need to establish which role(s) your business needs, depending on financial demands and business breadth. Here's a breakdown of the normal duties for each duty in a construction firm, and just how they can enhance your repayment procedure. Workplace supervisors use A great deal of hats, especially in a little or mid-sized building and construction company.

$1m $5m in yearly earnings A controller is typically in charge of the accounting department. A controller might set up the accountancy department (construction accounting).

The building and construction controller is in charge of creating precise job-cost audit records, taking part in audits and preparing reports for regulatory authorities. Furthermore, the controller is liable for guaranteeing your company adhere to economic reporting regulations and regulations. They're additionally required for budgeting and surveillance annual performance in relation to the yearly budget plan.

Pvm Accounting Can Be Fun For Everyone